- #MASSACHUSETTS ANNUAL REPORT FILING REQUIREMENTS HOW TO#

- #MASSACHUSETTS ANNUAL REPORT FILING REQUIREMENTS CODE#

- #MASSACHUSETTS ANNUAL REPORT FILING REQUIREMENTS PC#

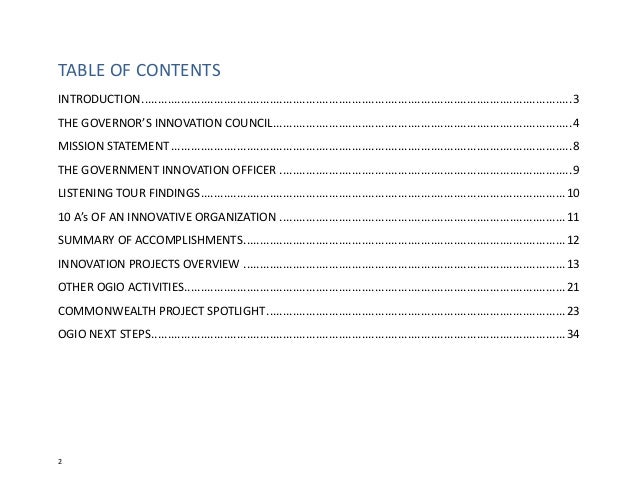

Independent Auditors’ Reports as Required by Title 2 U.S. Introduction of Massachusetts Annual Report.

#MASSACHUSETTS ANNUAL REPORT FILING REQUIREMENTS CODE#

Code of Federal Regulations Part 200, Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards (Uniform Guidance) and Government Auditing Standards and Related Information (PDF)įiscal Year 2017 (July 1, 2016–June 30, 2017)įiscal Year 2016 (July 1, 2015–June 30, 2016)

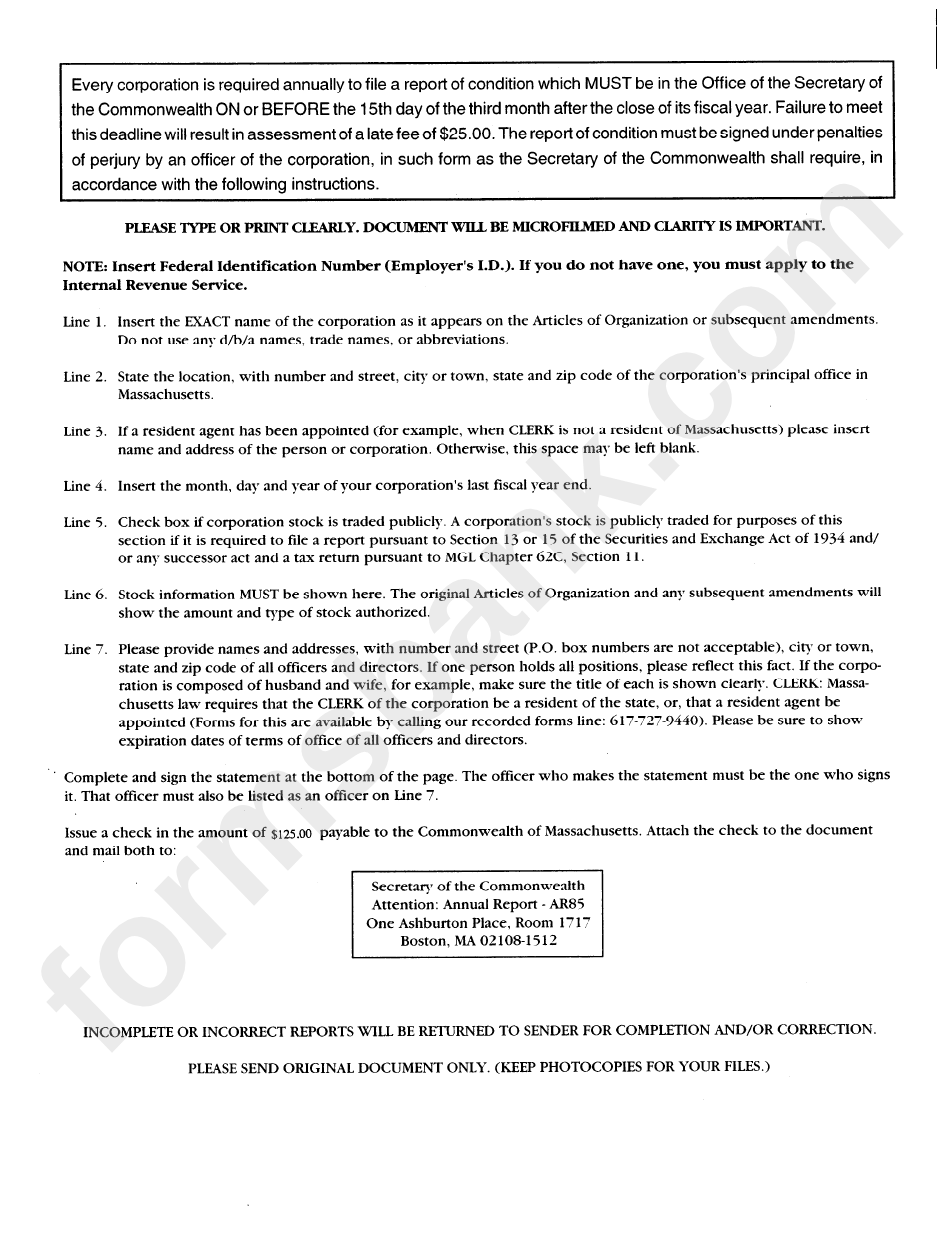

Is The Annual Report Of The State Of Massachusetts Why Is This Important Consider an annual report for most of your LLC’s annual audits. Corporation: Corporations in Massachusetts must file an annual report each year within two and a half months of the close of the. Under the age of 50, they must submit an annual report by November 1st. Data on the Individual Mandate: Tax Year 2008įiscal Year 2022 (July 1, 2021–June 30, 2022) ANNUAL FILING REQUIREMENTS TO MAINTAIN MASSACHUSETTS NONPROFIT File Attorney General Form PC, together with a copy of Form 990 or 990-EZ. Reports must be submitted 2.5 months after the end of the 12-month financial month. If your corporation is a non-profit organization, the annual report fee will be 18.50, and it will need to be filed by mail or online every year by November 1.Data on the Individual Mandate: Tax Year 2009.Data on the Individual Mandate: Tax Year 2010.Data on the Individual Mandate: Tax Year 2011 Starting an LLC in Massachusetts Let Incfile do all the paperwork for you for free.Data on the Individual Mandate: Tax Year 2012.We worked with the Massachusetts Department of Revenue to review enforcement of the requirement to enroll in health coverage.

The Remaining Uninsured in Massachusetts: Experiences of Individuals Living Without Health Insurance Coverage.Massachusetts Residents without Health Insurance Coverage: Understanding Those at Risk of Long-Term Uninsurance.July 2016 -The Blue Cross Blue Shield of Massachusetts Foundation published two reports about the remaining uninsured in Massachusetts co-authored by the Health Connector and the University of Massachusetts Medical School: November 2017 - The Massachusetts Individual Mandate: Design, Administration, and Results Only for forms submitted in hard copy, payment must be made using the Commonwealth of Massachusetts secure, web-based payment system found at: Payment for annual filings submitted in the new online Charity Portal must be made through the Charity Portal.December 2019 - Data on the Massachusetts Individual Mandate: Health Connector Analysis of Department of Revenue Tax Filers Data Tax Years 2013–2015 Non-Profit Organizations/Public Charities Division

#MASSACHUSETTS ANNUAL REPORT FILING REQUIREMENTS PC#

You may then fill out the Form PC and submit the hard copy (and any attachments) to: Starting an LLC in Massachusetts Let Incfile do all the paperwork for you for free. If you wish to submit your forms in hard copy, you must review the Form PC Instructions first, available here. You can find answers to frequently asked questions about the portal here.

#MASSACHUSETTS ANNUAL REPORT FILING REQUIREMENTS HOW TO#

Click here for instructions on how to register for a Charity Portal account and then filers may use the eForm PC and pay requisite fees through the Charity Portal, available here. The annual report is due annually within 2.5 months after the close of the. Please consider using our new online charities filing portal.Ĭharities may now meet their annual filing requirements through the AGO’s new online charities filing portal. A Foreign Corporations annual report fee is 125 (or 100 if filed electronically). We are processing Forms PC in the order received and there are delays for filings submitted in paper. See the Secretary of the Commonwealth website for additional information about becoming a LLC. The Form PC is filed annually by all nonprofit charitable organizations conducting business in the Commonwealth of Massachusetts. LLCs must also file an annual report with the Secretary of the Commonwealth.

0 kommentar(er)

0 kommentar(er)